There’s been plenty of publicity now on Hutt City Council’s decision to cut the proposed 7.9% rate increase for the year beginning July 1 to 3.8%. There’s too much business and household hurt as we recover from COVID-19 for the higher figure, and to go to zero just puts off dealing with a growing deficit and digs a bigger financial hole.

The 3.8% compromise has been described as an emergency/holding budget while we – as a community – debate in depth the spending priorities for the Long-Term Plan review in 2021.

For the average residential ratepayer, a 3.8% hike in the Council’s total rates revenue equates to an extra $122 for the year (or $2.35 a week). But other factors come into play on whether the increase on your rates bill is less or more than that.

First, there’s last year’s revaluation. Second, there’s what we decide about differentials.

Let’s start with the revaluation.

There’s a widespread misconception that when Quotable Value does the 3-yearly city-wide property valuation reassessments, if your property’s value goes up your Council rates will inevitably go up. That’s not necessarily true. In terms of rates impact, they key is how your property’s value has changed in relation to everyone else’s.

Think of the Council’s rates revenue requirement as a cake. The capital value of your home/property compared to everyone else’s decides what size of slice of that cake you have to pay for.

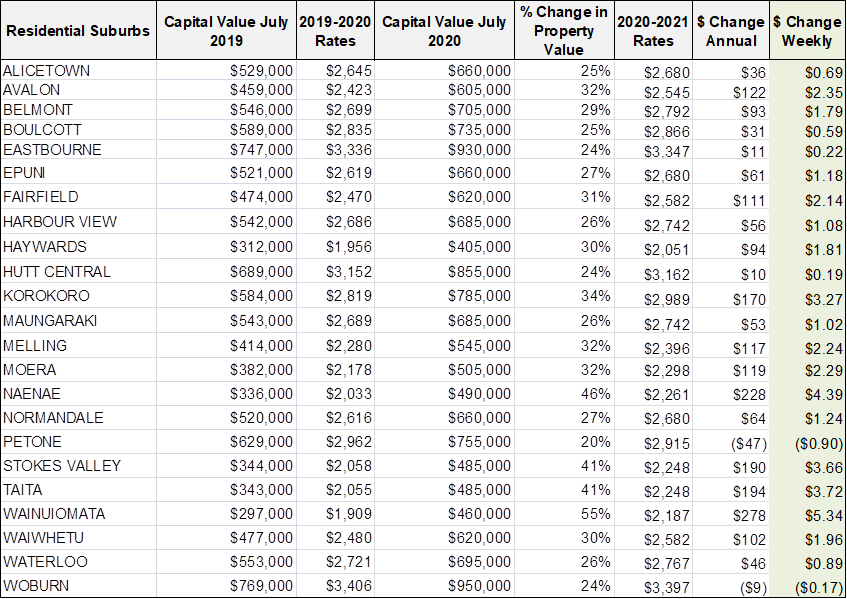

The average rise in value of residential properties in Lower Hutt in last year’s QV revaluations was 32%. Check out the table below.

The average residential property rises in Melling, Avalon and Moera were right on the 32% average. You’ll see that with the 3.8% bump in the city’s total rates take added in, the average annual rise for those suburbs is $117-$122.

Very different story for Wainuiomata. Average house values there leapt 55% – ways above the city’s 32% average. Their average annual rates increase is therefore $278.

With 41% average valuation rises in Stokes Valley and Taita, home owners in those suburbs face an average $190 and $194 bigger bill respectively. Naenae residents are also hit.

Petone folk, with a 20% valuation increase, well under the city’s average, actually end up with a rates decrease of -$47. Hutt Central, with average property values up 24%, face only $19 extra on their rates bill.

Important note: These are all suburb averages. If your home is worth less or more than the suburb’s average, your rates bill will be accordingly higher or lower.

A couple of things about these valuation changes. Even if Council went for a zero increase in the rates take, homeowners in Taita, Naenae, Stokes Valley and Wainuiomata were always in for paying more because the jumps in their revaluations were significantly higher than in the rest of the city. But note that even with a 55% average jump in property value, and council’s proposed 3.8% increase added in, Wainuiomata’s average rates bill ($2,187) is still lower than every other part of the city save for Haywards.

Also, many times in past years the suburbs whose valuations this time are lower (e.g. the likes of Woburn and Eastbourne), have seen bigger valuation rises and thus have shouldered higher than average rates increases.

Second thing. Council has no influence over valuations, nor can it somehow manipulate or circumvent valuation changes in certain suburbs to favour others. There would be a legal challenge straight away.

In light of the unprecedented upheaval from the pandemic and that our generally less well off suburbs are going to be badly affected by rates rises, Mayor Campbell Barry has written to the government asking whether it is possible – in terms of 20/21 rates – to ‘freeze’ valuations to what they were prior to the revaluation last September. The government has yet to respond.

But even Mayor Barry has acknowledged that if the government allowed this, there would be a downside were we to adopt the ‘freeze’. It could mean some suburbs, if another valuation exercise was done next year, could be hit by an even bigger hike/rates impact.

So that’s valuations.

There’s another tool that has an impact on the sharing of the city’s total rates revenue – differentials.

Remember the cake analogy as a way of looking at the how much rates money is needed to pay for pools and local roads and sewerage pipes and all the rest of it? Councils are able to start dividing up chunks of the cost of the cake based on ‘classes’ of ratepayer (residential, rural, business central, business suburban, etc). We can put in place different rates amounts per dollar of capital value for these groups of ratepayers, but are required to take into account principles such as fairness, consumption of services, public vs private benefit, etc.

Valuations have again had a part of play. In last year’s QV property assessments, residential property increased 31.8% but commercial property values only went up at average of 16.9% and utilities properties just 12.8%.

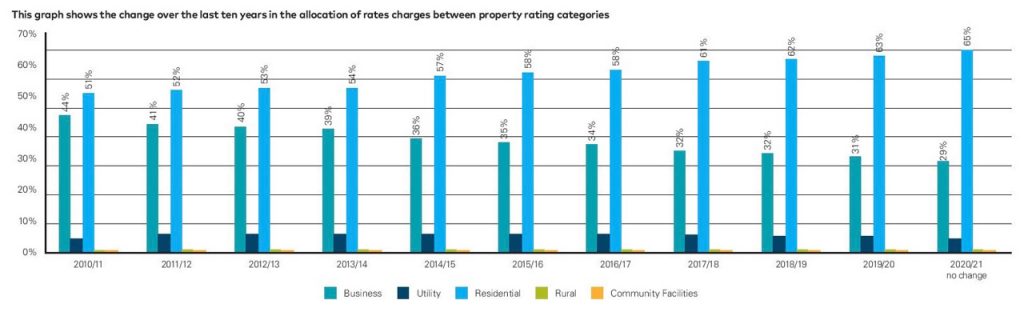

Back in 2012, general business rates were almost four times the amount of residential properties of the same value. In 2010/11, despite there being far more residential ratepayers than numbers of businesses, residents paid 51% of Council’s total general rate revenue, and businesses paid 44%.

Councillors of the day recognised that businesses did not benefit four times more from Council services than residents, and with the threat of legal action from the business community spurring them along, decided on a policy of gradually reducing the business differential over a 10-year period. The aim was to the point where businesses’ rates per dollar of Capital Value had dropped to 2.8 times that of residents’.

The target was that residents should pay about 60% of the total general rates take.

The thing is that over the intervening years, increases is residential property values have accelerated faster than for commercial properties. The result is that in the current financial year, homeowners are picking up 63% of general rates and businesses only 31%.

If we continued the ‘gradual decrease’ policy, next year residents would shoulder 65% of the general rates burden and businesses only 29%. That would mean another $28 p.a. of rates on the average homeowner on top of the $122 extra they’re already facing.

Check out the graph below.

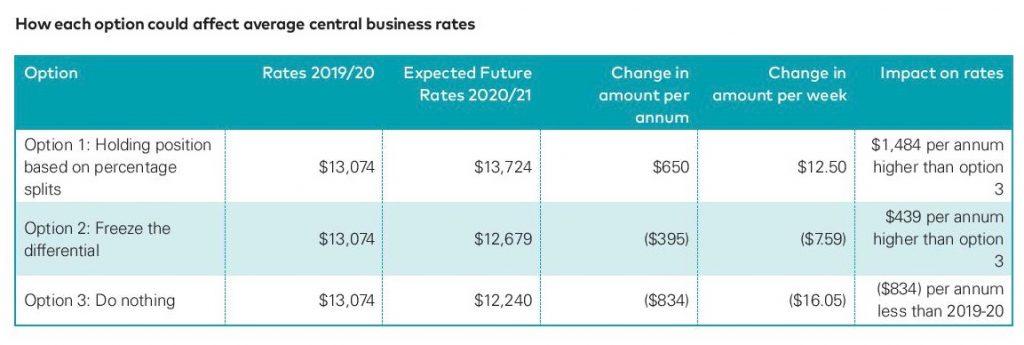

Councillors are recommending holding the rates differentials to the percentage splits that applied in the current year (i.e 63% from residential property, 31% from commercial property). That eliminates the extra $28 the average residential ratepayer would otherwise have faced, but it does mean significantly higher rates bills for commercial properties than they would have faced if we continued the gradual decline of business differentials. See the graph below for the impact, for example, on the average value central business property. Instead of an $834 rates decrease, they face a $650 increase.

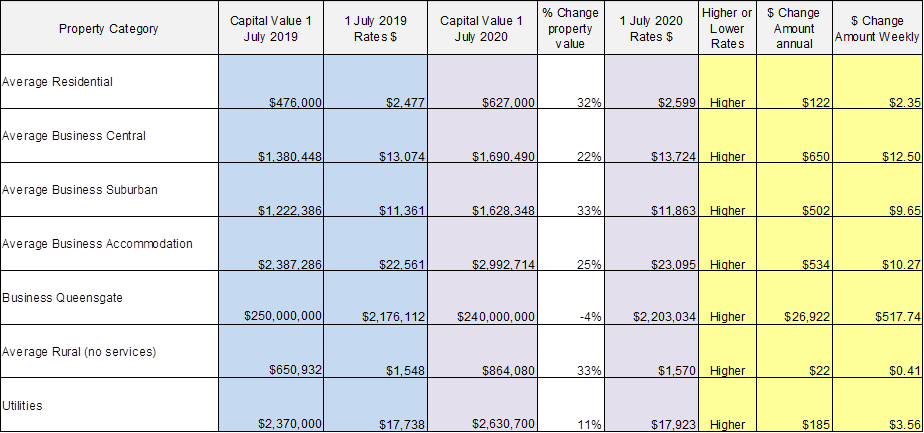

And here’s the overall impact of holding the differential percentages:

Is the proposal fair, given that businesses are also facing hard times from pandemic disruption? Your answer probably depends on whether you own a business that pays rates!

The residential and commercial sectors have long been at loggerheads on the proper share of council costs. Homeowners tend to argue businesses can claim tax deductions on rates paid. Businesses point out in a competitive marketplace, their costs drive the prices of their goods, and besides, rates should at least try to reflect who benefits from council services.

Over to you. What’s the fair call on this?

I’d love to hear your thoughts – email simon.edwards@huttcity.govt.nz