As locals debate the pluses and minuses of infill houses popping up everywhere in the city, a common refrain is the pressure this puts on our creaking infrastructure. There are grumbles that current ratepayers will have to fork out big money for the upgrades to pipes and roads that all this growth will require.

So it’s timely to inject the topic of ‘Development Contributions’ into the discussion. Our proposed Long-Term Plan includes some pretty hefty hikes in these contributions and Council is looking for people’s feedback.

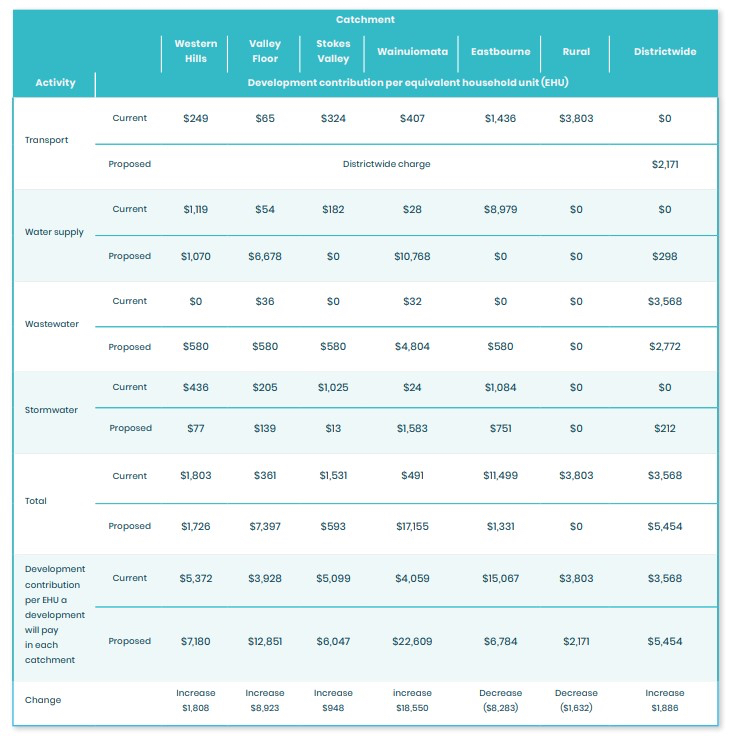

For example, you’ll see from the table below that it’s proposed the fee put on developers per ‘equivalent housing unit’ (EHU) in Wainuiomata would go up by $18, 550 but in Eastbourne would actually drop by $8,283. More on why later. (Note: 1 EHU = demand placed on infrastructure by 1 nominal household. For example, a 225m2 industrial development = 1 EHU for water and stormwater. A formula differential will be used to calculate the development contribution for a smaller residential unit, such as an apartment.)

First, what’s a development contribution (DC)? All sorts of sections of the Local Government Act 2002 relate to DCs but the guts of its is this: the capital cost of providing growth-related infrastructure can be funded by a charge on developers of new housing and commercial buildings. Principles relating to fairness and equity, simplicity, certainty and transparency and consistency must be applied.

Hutt councillors propose that 100% of the capital costs of growth-related water, wastewater, transport and stormwater infrastructure should be liable for DCs. We’re not proposing it applies to reserves and community facilities, which is also possible under the legislation.

Council is anticipating that just over $74 million of the estimated $506 million we’ll spend on the 3Waters and roading in the next 15 years will come from development contributions. That’s a big chunk of money that would otherwise fall on all ratepayers, were projects to proceed at the scope and size projected.

Development contributions can be levied on future growth capital expenditure (up to 30 years), and the interest cost of debt incurred to fund those assets. But DCs are not allowed to be used to fund operating and maintenance costs, nor can they be charged to pay for the component of pipe and road upgrades that need to be done even if there was no growth in the particular suburb or ‘catchment’.

So why are the proposed DCs going up in some parts of the city, and down in others? Quite simply, it’s related to where the infill/new housing is happening most, compared to where it was happening the last time our DCs were reviewed, and thus where pressure is on infrastructure. Very little growth-related infrastructure is planned for Eastbourne, for example, but to cope with fast-rising population growth Wainuiomata needs a third reservoir ($43m) extra fire flow pipe upgrades ($6m) and the need to pay for its share of projects such as the main outfall sewer renewal ($196m) and sludge dryer renewal at Seaview sewage treatment plant ($44m).

Quite a bit of growth is also happening on the Valley floor, which is why DCs in that catchment are to go up by $8,923 to $12,851.

Depending on what you tell us during Long-Term Plan consultation, the average DC across the city will be $5,454 – an increase of $1,886.

If you’ve stuck with the article so far, the huge downside of raising development contributions has probably also occurred to you. Is this the thing to do right when we’re in the middle of a housing affordability crisis?? Developers won’t pay these DCs out of the goodness of their hearts; they’ll be passed on to the buyer of the house or apartment.

Three points to ponder on that front.

1/ Lower Hutt’s current DCs are comparatively low compared to many cities. These proposed changes bring us more in line with what similar sized councils charge.

2/The highest charge (Wainuiomata’s) equates to around 4% of the median house price in the city, or just 10% of house price increases over the last five years.

And 3/ the alternative is that all ratepayers shoulder the burden of the component of infrastructure costs related to growth, when they’ve already paid/are paying for existing infrastructure debt.

Your call.

- Have your say on this topic, as well as rates projections and plans for other projects in our city as part of Long-Term Plan consultation, running until May 6. Click here. (The section on development contributions starts on page 78 of the consultation document.)